What is DDPI (POA)?

Demat Debit and Pledge Instruction (DDPI) is an optional document/method of POA(Power of Attorney) that allows a broker like Zerodha and Upstox to sell (debit) securities from a our demat account and deliver them to the exchange.

Clients who have opened accounts online, by default they use the CDSL TPIN to authorize the debit of securities, making the submission of DDPI optional.

To authorize CNC (Cash and Carry) sell transactions using the CDSL TPIN, we can generate the daily required TPIN by following specific steps outlined in the system. Once DDPI is submitted, clients no longer need to enter the CDSL T-PIN and OTP to sell shares, streamlining the trading process.

- What is DDPI (POA)?

- Common Issues with Daily TPIN

- Benefits of Activation of DDPI

- How to Activate DDPI and as permanent solution of Daily TPIN?

- How to Activate DDPI in Upstox demat?

- How to Activate DDPI in Zerodha?

- How to revoke DDPI (POA) and revert back to TPIN in Zerodha?

- How to Activate DDPI in Angel One?

- FAQs (Frequently Asked Questions)

Common Issues with Daily TPIN

-Daily TPIN requirements can be cumbersome for many traders and also early users.

–Defeats the idea of GTT sell orders, as many trades can get adversely affected.

-TPIN OTP receiving issues at crucial moments.

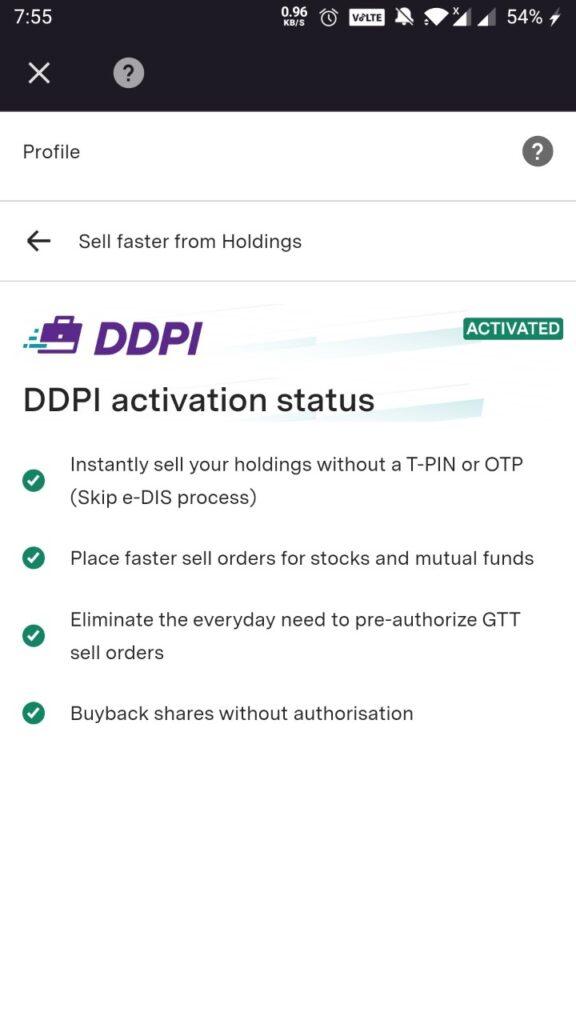

Benefits of Activation of DDPI

- Transferring shares from your demat account to the exchange upon their sale.

- Pledging/re-pledging of securities in favour of a Trading Member (TM) or Clearing Member (CM) for meeting margin requirements.

- Transferring mutual fund units from your demat account upon their sale.

- Transferring your shares in open offers ( ie. buybacks/delisting/acquisitions) on the stock exchange.

How to Activate DDPI and as permanent solution of Daily TPIN?

To avoid the hassle of daily TPIN, this section will introduce DDPI method in Upstox and Zerodha:

How to Activate DDPI in Upstox demat?

The whole process is Online and easiest to follow, for users utilizing the updated version of the Upstox app, follow these steps:

If you don’t have Upstox demat account, refer here for Referral Code and get free demat account.

- Log in to the Upstox app using your 6-digit PIN or biometrics.

- Navigate to the bottom of the screen and click on ‘Account.’

- Select ‘Profile.’

- Click on ‘My Account.’

- Again, click on ‘Profile.’

- Locate by scrolling down and click on ‘Sell instantly with DDPI.’

- Proceed by clicking on ‘Continue to enable DDPI.’

- Accept the presented terms and conditions, then click on ‘Continue to pay.’

- Opt for ‘Pay from wallet.’

- Note: The charge includes Stamp Duty, other applicable fees, and GST. around Rs. 150

- A ledger entry for DDPI, indicating the debited amount, will be available within T + 1 trading day.

- Alternatively:

- If your account balance is insufficient, click on ‘Add funds.’

- Input your Aadhaar number. Accept the conditions, then click on ‘Request OTP.’

- Enter the OTP received on your Aadhaar registered mobile number.

- Your request will be successfully submitted.

- Note: If you submitted your DDPI Activation request before 8 PM, approval will take T + 1 trading day. However, submissions after 8 PM will undergo the approval process for T + 2 trading days.

Upon submitting the request, a confirmation from Upstox about your request will be received on the next trading day at 8 AM.

How to Activate DDPI in Zerodha?

- The activation process is online/offline, and clients must ensure that the signature on DDPI matches the previously uploaded signature while opening the Zerodha account in offline mode application.

- Online:

Log into console.zerodha.com.

Click on Account.

Click on the arrow and then click on Demat.

Click on Enable Demat Debit and Pledge Instruction (DDPI).

Accept the terms and conditions. Click on Continue.

Click on Proceed and then on Sign Now.

Accept the terms and conditions. Enter the Aadhaar number.

Click on Send OTP, enter the OTP.

Click on Verify & Sign, it’s done!! - Offline:

Download DDPI form here from the official website of zerodha.

Fill it like this sample copy (Client ID is the 16-digit Demat ID that can be found by visiting console.zerodha.com/account/demat.)

Courier it to the following address:

Zerodha

153/154, 4th Cross,

J.P Nagar 4th Phase,Opp. Clarence Public School,

Bengaluru – 560078 - As the activation process is offline, and clients must ensure that the signature on DDPI matches the previously uploaded signature while opening the Zerodha account.

- The DDPI activation typically takes up to 72 hours, with a confirmation email sent once the process is completed.

Benefits of Adopting Preventive Measures

Implementing DDPI saves time and effort in trading through Demat account:

-hassle free GTT orders

-not having to remember TPIN

-free from OTP issues of network

How to revoke DDPI (POA) and revert back to TPIN in Zerodha?

In Zerodha the DDPI POA can be easily revoked through online and offline.

Online -Individual account holders whose Aadhaar is linked to a mobile number can revoke the POA and DDPI by e-signing the Revocation of Power of Attorney-DDPI form, here.

For Offline Refer the Zerodha official website too, here.

How to Activate DDPI in Angel One?

The process of DDPI activation is easiest in Angel One as during Account Opening it gives option (Free).

If you haven’t activated during account opening:

1. Go to the ACCOUNT page and click on the Profile icon.

2. On the Profile page, click on the ‘View All Categories’ option below.

3. On the ‘View All Categories’ page, click on the ‘DDPI’ section. If you have not activated DDPI, the status will show as ‘Inactive’.

4. Next, click on the ‘PROCEED TO E-SIGN’ button.

5. Next, in order to e-sign, enter your own Aadhaar number and check the box below to acknowledge the terms and conditions.

6. Enter the OTP sent to the mobile number linked to your Aadhaar Card.

Done!

Conclusion

In conclusion, avoiding daily TPIN in Zerodha and Upstox Demat accounts is not only feasible but also highly beneficial. By understanding the importance of DDPI and implementing activation, traders can enhance accounts and streamline their trading experience.

FAQs (Frequently Asked Questions)

- Is permanent TPIN secure?

- Yes, permanent TPIN adds an extra layer of security to your account without compromising safety.

- Can I switch back to daily TPIN if needed?

- Yes, users have the flexibility to switch between permanent DDPI and daily TPIN as per their preference.

- What if I face issues with the implementation process?

- Users encountering issues can reach out to customer support for prompt assistance.