SEBI has released new mainboard IPO Allotment rules for HNI – NII categories in and changed from definite proportionate to lottery system, let’s dive into details of how does IPO Allotment works for better chances in every next IPO. 😀

- Who are High Net Worth Individuals (HNI) or Non-Institutional Investors (NII) in Indian Stock Market?

- What's bHNI vs sHNI under HNI/NII Category in IPO?

- SEBI's Latest IPO Allotment Rules for HNI

- What is Basis of Allotment in IPO, tricks?

- How to apply online IPO for HNI category in Zerodha, Upstox etc.?

- How many shares/lots will you get in HNI category, if alloted?

Who are High Net Worth Individuals (HNI) or Non-Institutional Investors (NII) in Indian Stock Market?

HNI/NII investors are individual investors who invest over 2 lakhs in IPO allotment bids and are not required to register with SEBI to apply for shares. To delve deeper into this category, we aim to discuss HNI IPO allotment regulations.

What’s bHNI vs sHNI under HNI/NII Category in IPO?

NII or non-institutional investors encompass Indian residents, NRIs, HUFs, corporate entities, companies, trusts, scientific institutions, and societies. Any Individual applying for more than 2 lakh shares in IPO Allotment fall under the NII category.

bHNI : Bids above 10 Lakhs in a single IPO.

sHNI : Bids between 2 Lakhs and 10 Lakhs in a single IPO.

In most Mainboard IPO : At least around 15% of the offer is reserved for this category. Moreover, this category often experiences significant oversubscription due to its smaller size, prompting other individual investor segments to bid within it, as the chances of allocation are higher.

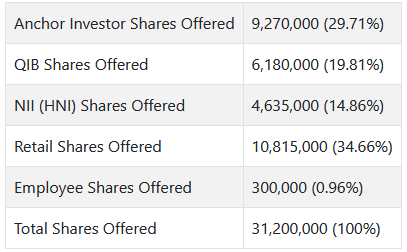

Here’s an example of recent Mainboard IPO:

Vishnu Prakash R Punglia IPO Allotment Reservation:

Vishnu Prakash R Punglia IPO a total of 31,200,000 shares are offered.

QIB: 6,180,000 (19.81%), RII: 10,815,000 (34.66%), HNI/NII: 4,635,000 (14.86%).

Here like most, applying in bHNI gives better allotment chances due to less ratio of applications to shares to bid for i.e almost 10%.

जानिए एचएनआई आईपीओ(HNI-IPO)आवंटन/अल्लोत्मेंट कैसे होता है?

shni vs bhni which is better ?

Mostly, applying in big HNI category gives much better allotment chances due to less ratio of applications to shares to bid for i.e almost 10% but it requires almost five times the fund(above 10 lakhs) of minimum small HNI fund (around 2 Lakhs).

SEBI’s Latest IPO Allotment Rules for HNI

IPO ALLOTMENT Basis:

1. Since September 2022, IPO allotment rules for HNI is based on a LOTTERY DRAW SYSTEM.

2. The group of bidders are formed(based on lots applied) for each category and their ratios are kept somewhat proportionately same for all these groups for both sHNI and bHNI. — (Refer Basis of Allotment Vishnu Prakash IPO example below)—

3. It’s now regardless to subscription levels if oversubscribed but it is allotted definite proportionately, only if undersubscribed.

Earlier, it used to be proportionate. For example, if the NII/HNI category experiences oversubscription of 100 times, and assuming you, as an HNI investor, applied for 1000 lots, you would have been allocated 10 shares.

Few other specific rules for HNI/NII application:

1. What sets this category apart from others is that investors here cannot bid at the cut-off price, nor can they withdraw or modify their bids.

2. Furthermore, there is no lock-in period for both HNIs, can sell their shares on the listing day to realize profits just like retail category.

Open Upstox Account: Use Referral Code & get upto 1500 for each new referral, click here.

What is Basis of Allotment in IPO, tricks?

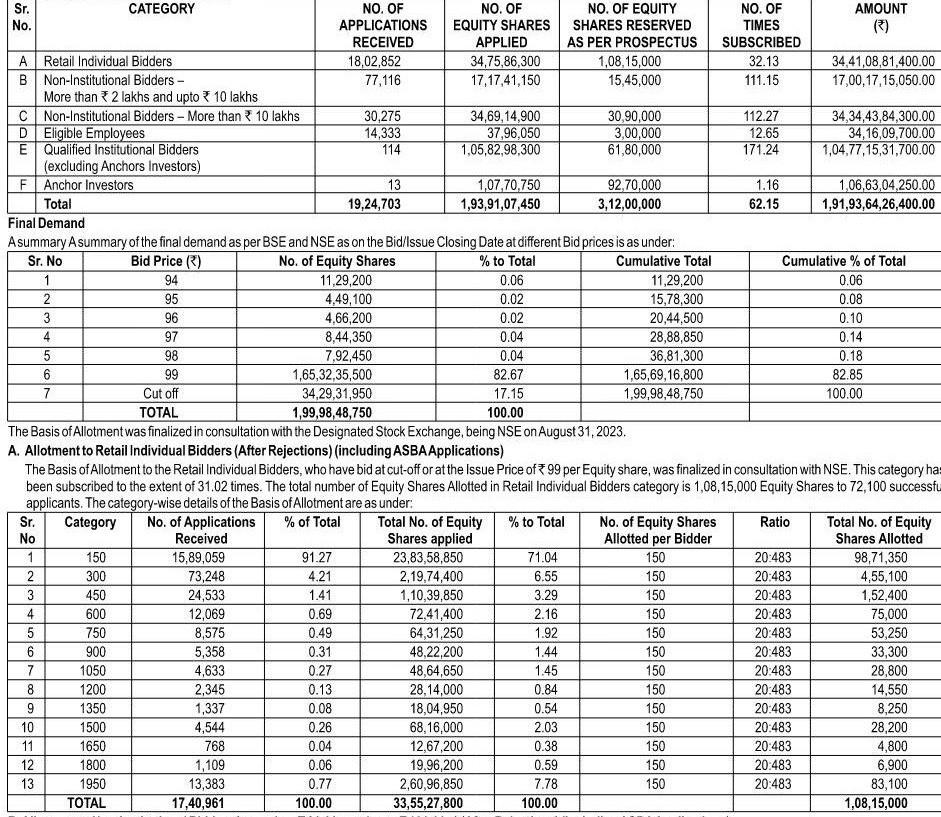

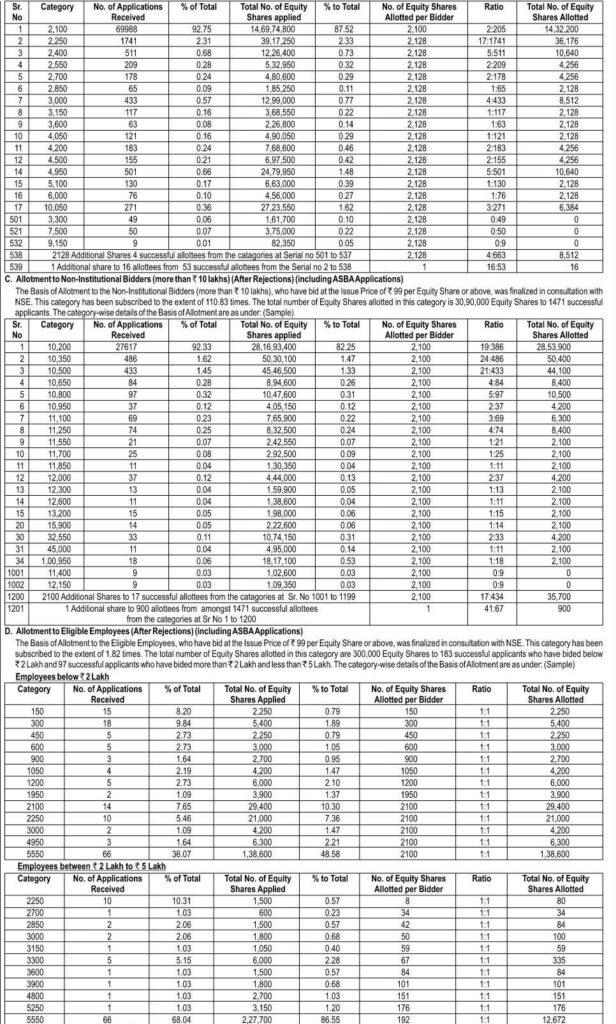

To better understand IPO Allotment Rules for HNI let’s analyze our example from Vishnu Prakash IPO’s published official BOA to get real idea of Basis of Allotment:

1. It is generally divided into 3 to 4 tables in allotment- Retail, sHNI and bHNI and Employee (if applicable).

2. These are further divided among Bid Groups (mentioned under Category coulumn in Tables below) by bidders in their respective categories.

2.1 Table A. – Retail Applications with their respective ratio of allotted to applied application shares.

2.2 Table B. – Small HNI/sHNI ( bids from 2 lakhs to 10 lakhs) with their respective ratio of allotted to applied application shares.

2.3 Table C.- Big HNI/bHNI (bids above 10 lakhs) with their respective ratio of allotted to applied application shares.

2.4 Table D. – Employee/Shareholder or both Quota

3. FACTORS THAT ARE CONSIDERED DURING ALLOTMENT :

Considering that if all IPO application details are error free and placed at cutoff price, so that it won’t be rejected .

3.1 The Bid Group (Category column in tables below) in which you will be considered. Example: In Vishnu Prakash IPO 1 lot = 150 share and 1 HNI (min) bid = 14 lots = 2100 share, when you apply min HNI bid you will be considered into that particular group of 14 lots.

3.2 The RATIO of that particular BID Group. Example: In Table 2 – Ratio of each group gets slightly better as we go below and the lots increase.

If we refer the ratios of each group, this effectively means to increase your probability just minutely – Apply 5-6 lots more than the minimum of that HNI category, as it places you in a group with slightly better probability.

3.3 Just to point one far fetched hypothetical theory – you may consider applying from WOMEN’s Demat accounts, which have worked for many.

4. WHAT NOT TO DO?

4.1 Don’t place bid lower than cutoff, especially if oversubscribed, your application will get rejected first (every IPO almost 2% get rejected like this).

4.2 Don’t place bid lots size so high or something that is not in multiples of lot size that would put you in an obscure (separate) Bid Group that doesn’t have any other application, which could sometimes go against you in mainboard IPOs. (Some bids of even 2 crores of bHNI have been rejected in various IPO due to this)

4.3 Don’t apply 3rd Party ASBA IPO application, it has been stopped by almost all banks, check with yours first.

Yet, Mainboard IPO allotment rules for HNI has been more of a probability game now and the criteria can not be accurately predicted, being a lottery system and change in share lot size for each IPO makes it slightly unpredictable, although we can put our best IPO bid when we know how backend works.

BUT for SME IPO allotment rules for HNI is still the old process i.e you can have a definite allotment, click here to see how.

Table B. (below) Allotment to HNI/NII (between 2 lakhs and 10 Lakhs) After Rejections

According to IPO allotment rules for HNI, the Basis of Allotment is released for every IPO in a week after Allotment.

How to apply online IPO for HNI category in Zerodha, Upstox etc.?

To be considered appropriately in basis of allotment under IPO Allotment Rules for HNI, one must apply without errors in application, here’s the process to apply in HNI category.

1. Find ASBA/IPO option in your bank’s Netbanking website or mobile app.

2. Add Beneficiary Details if you have Demat account with any other DP (instead of your ASBA bank) such as Zerodha, Upstox etc.

3. It would ask for CDSL/NSDL and DP ID/BO number that is usually 16 or 8 digit number that you can find in Profile/Settings>>Demat of Zerodha, Upstox etc.

4. Then fill in your Bid details of shares and Price, system will automatically put you in respective sHNI, bHNI or retail categories.

Keep the bid minimum of that category in mainboard IPO, as it would not have much effect on allotment, although at 5-6 lots more than minimum, the chances improve (as we saw above in BoA).

5. Make sure the details are correct and then Submit.

6. The cutoff time for ASBA IPO application submission is usually 3:00 PM on closing day of IPO, please find your bank’s timings to be on safe side.

7. Don’t apply 3rd Party ASBA IPO application, it has been stopped by almost all banks, check with yours first.

NOTE: According to IPO Allotment Rules for HNI /NII bidders generally can’t use the UPI option for IPO bidding because the UPI system has a limit of 1 lakh rupees (although Zerodha and few other demat accounts has limit of 5 lakhs for UPI mandate which allows for small HNI) for IPO mandate. However, if bHNI investors want to apply, their bidding amount should be more than 10 lakhs. So, they need to choose either the online or offline ASBA method.

How many shares/lots will you get in HNI category, if alloted?

Accordingly, for HNI – both small HNI allotment and big HNI ipo allotment rules, allotees in an IPO will get only shares of around 2 lakhs i.e basically the minimum bid amount for sHNI.

For example, according to above example of Vishnu Prakash IPO, if alloted one would get 2100 shares of amount ₹207900.