In stagnant stock markets, investors are always on the lookout for strategies to maximize their returns. One such intriguing strategy is Buyback of Shares, often referred to as stock repurchase. In this article, we’ll delve deep into the concept of share buyback, explore how it can help you pocket over ₹1000 in just a week, with SEBI data as proof from 2022.

Now, let’s embark on this enlightening journey to demystify Buyback of Shares and unveil the secrets of definite earning.

1. Buyback of Shares Meaning

Imagine you are a shareholder in a company, and the company decides to buy back some of its own shares from you/market at generally higher price.

This process is known as a share buyback or stock repurchase. Essentially, the company is using its own funds to acquire its outstanding shares, which are then retired or held as treasury shares.

Example: TCS, Infosys, Wipro etc buyback every few years, here the issue size of Tata Consultancy Services Buyback 2023 is of 40,963,855.00 equity shares at ₹4150 per share aggregating upto ₹17,000.00 Crores.

2. The Mechanics Behind Share Buybacks

Buyback of Shares can take various forms:

Tender Offer and Open Market, the most common method is through open market purchases. In this scenario, the company buys its shares from existing shareholders on the open market, just like any other investor would.

But strategy is for mainly Tender Offer is where the company gives out a buyback rate with a Record date (shareholders before this date are only eligible), like this another time by TCS in November 2023.

3. The Benefits of Share Buyback for company

Buyback of Shares offer several advantages for both companies and shareholders. Some of the key benefits include:

- Enhanced Shareholder Value: By reducing the number of outstanding shares, share buybacks can boost the company’s earnings per share (EPS), making it more attractive to investors.

- Capital Allocation: Companies often use excess cash for buybacks, which is more tax-efficient than paying dividends. This strategic allocation of capital can benefit shareholders.

- Flexibility: Share buybacks provide companies with flexibility in managing their capital structure and returning value to shareholders.

- Tax Exemptions: Companies do buybacks as a replacement for dividends due to lower taxation.

4. Best Strategy for Buyback of Shares

Consider these steps strictly for retailers:

- Identify Companies with a History of Buybacks: Research companies with a consistent track record of share buybacks.

- Monitor Buyback of shares Announcements: Keep a close eye on company announcements regarding upcoming buybacks from stock market news.

- Timing is Key: Buy shares before the buyback announcement, when prices are typically lower mostly even before announcement of Record date as the price climbs after announcement and tender/sell during the buyback.

- For Retailer – There is no need for getting much into Acceptance Ratio etc.( buyback depends on the AR (acceptance ratio).

If you buy more than 1 then the acceptance will be same percentage as final AR of retail category. Let’s say if final AR is 40% and if you tender 5 shares then 2 shares will be accepted. If final AR is 25% and if you tender 5 shares, then only 1 share will be accepted, so just…

Example: BUY just one share of TCS from demat account (different unique PAN card) before record date that is 25 November 2023 (Saturday) but buy before or on 23rd Nov so that you receive share in T+1 settlement by 24th November. - When the tender offer opens, tender only 1 share, apply more if you hold multiple shares according to the ratio that you will receive in email.

UPDATE: [Window will open on TCS Buyback Dates : 01 – 07 December 2023 ]

Retail Entitlement Ratio : 09 Shares against 55 Share (16.79%) – Date of Receipt of Payment / Settlement of Bids : 10-14th December

Ex: In Zerodha – Go to Console – Corporate Actions – Buyback – Select Company : TCS - The Buyback will definitely be sold back to company, you can test with more than one share but generally in large cap TCS with high share price only one is selected.

This is multiple times tested strategy, go ahead and try to buy share first at reasonable price. 😀

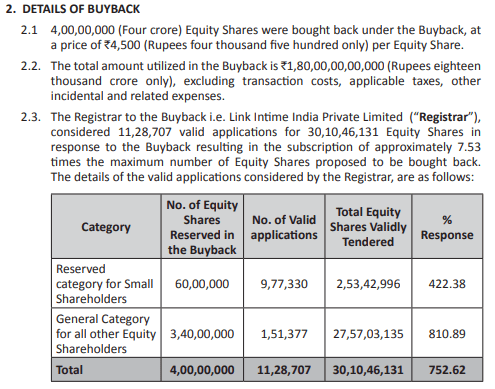

Below is an example of results of TCS 2022 Buyback of shares Tender Offer, data is taken from SEBI website, refer for more details. You can see the General Category section, according to application and reserved ratio atleast 1 share was tendered.

Latest SEBI IPO Allotment Rules for HNI – Mainboard [2023] | Basis of Allotment (BoA) Tricks | Best Process to apply IPO in HNI from Zerodha, Upstox etc.

5. How is buyback of shares taxed on shareholders?

When a corporation repurchases its own shares, it incurs taxation. Nevertheless, pursuant to Section 10(34A) of the Income Tax Act, the proceeds that shareholders derive from such buybacks are eligible for a tax exemption.

Let’s clarify this with an example: NO TAX

ABC Ltd., a steel manufacturer, announces a buyback of 1,000 shares at the current market price of Rs. 650. These shares were initially issued by the company a decade ago at Rs. 50.

In this scenario, the tax incurred by the company is calculated as follows:

Net Distributed Income = (1000 shares x Rs 650 per share) – (1000 shares x Rs 50 per share) = Rs 6,00,000.

Tax on buyback = (Rs 6,00,000 x 23.296%) = Rs 1,39,776.

Hence, the company is liable to pay a tax amount of Rs.1,39,776.

However, shareholders or investors will not incur any tax in this process.

6. Risks and Considerations

While Buyback of shares can be lucrative, it’s important to be aware of the associated risks:

- Market Volatility: Share prices can be volatile, impacting the success of buyback strategies. Example: if you buy share at high price range as it climbs up till the record date.

- Regulatory Changes: Keep abreast of any regulatory changes that may affect share buybacks, which is quite rare but still keep an eye on news.

Frequently Asked Questions (FAQs)

Q1: What is the primary objective of Buyback of Shares?

A1: The primary objective of a share buyback, also known as a stock repurchase, is for a company to purchase its own outstanding shares from the market. This can be done for various reasons, including increasing shareholder value, reducing the number of outstanding shares, and signaling confidence in the company’s financial health.

Q2: How does a Buyback of Shares impact a company’s financial statements?

A2: A share buyback can impact a company’s financial statements in several ways. It reduces the number of outstanding shares, which can increase earnings per share (EPS) and improve financial ratios like return on equity (ROE). However, it also reduces the company’s cash reserves, which could limit its ability to invest in growth opportunities.

Q3: Are Buyback of Shares always a good sign for investors?

A3: While share buybacks can signal financial strength and enhance shareholder value, they are not always a guarantee of success. Investors should consider the company’s overall financial health, growth prospects, and the motivation behind the buyback before making investment decisions. Sometimes, companies may repurchase shares to offset dilution from stock options or simply due to excess cash on hand.

Q4: What is the difference between a tender offer and an open market buyback?

A4: In a tender offer, a company directly offers to purchase shares from existing shareholders at a specified price and within a set time frame. An open market buyback, on the other hand, involves the company buying its shares from the open market over an extended period. Tender offers are often used for specific repurchase programs, while open market buybacks are more gradual and ongoing.

Q5: Can retail investors participate in a company’s share buyback program?

A5: Typically, retail investors can participate indirectly in a company’s Buyback of Shares program by holding shares of the company’s stock. When a company buys back shares, it usually does so from the open market, which can affect the stock’s price and potentially benefit shareholders. However, the ability to sell shares to the company directly may be limited to larger institutional investors.