In today’s dynamic financial landscape, investing in Initial Public Offerings (IPOs) has become an attractive opportunity for investors looking to grow their wealth. Among various types of IPOs, Small and Medium Enterprises (SME) IPOs are gaining prominence due to their potential for high returns and the chance to support growing businesses. In this comprehensive guide, we will delve into everything you need to know about SME IPOs, including the risks involved and measures to mitigate them with examples.

- What is SME IPO?

- What is SEBI Eligibility Criteria for SME IPO?

- What are SME IPO exchanges?

- How does trading takes place in SME IPO?

- Can Retail or HNI apply for SME IPO?

- Risks Associated with SME IPOs

- Best SME IPO Lisitng Strategy

- Case Studies: SM5E IPO Success and Failures

- Mitigating Risks in SME IPO Investments

- Conclusion

What is SME IPO?

An SME IPO is an initial public offering to get listed on stock market for small and medium enterprises (SME). It allows these relatively smaller market cap companies to issue shares to the public for the first time, enabling them to raise funds for expansion, working capital, or debt repayment.

Fun Fact: In India, SMEs provide employment to 40% workforce and constitutes around 50% Exports from India.

SME full form is Small and Medium Enterprises and these are the backbone of most developing and developed economies.

They are often characterized by their relatively small workforce, modest annual turnover, and a significant contribution to employment and economic growth. SME IPOs are designed to provide these companies with a platform to raise capital and expand their operations.

What is SEBI Eligibility Criteria for SME IPO?

In order to provide small and medium-sized enterprises (SMEs) and startups with an equitable opportunity to secure funding from the public, the NSE (National Stock Exchange) and the BSE (Bombay Stock Exchange) have instituted dedicated SME IPOs platforms.

These platforms, namely NSE Emerge and BSE SME, are specifically designed to facilitate the listing and trading of SMEs.

Companies with minimum post issue capital of more than 1 crore and less than 25 crores are eligible for SME IPOs in India.

The other requirements for SME IPOs company directors/promoters/investors are same for mainboard IPO, where the said persons should not be defaulters, offenders or disqualified from accessing the capital markets, although there are even more multiple different nitty gritty about eligibility at NSE and BSE exchanges but for us this may suffice.

What are SME IPO exchanges?

- As SME IPO have low liquidity and traded with different terms and conditions, different exchange created as mentioned above BSE SME in 2012 and later NSE Emerge.

- The SME IPO gets listed here can migrate to Main Exchanges once it gets bigger market cap upto a certain defined level.

How does trading takes place in SME IPO?

- Firstly, after listing trading can be done through your existing DEMAT Account, there is no need for any different or new account.

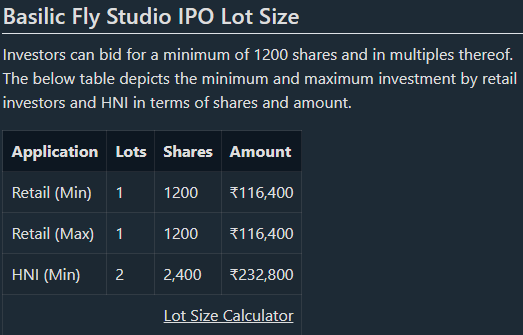

- The trading of SME stocks only takes place in lots of shares and not allowed for trading a single share, minimum lot size is decided based on offer price of shares.

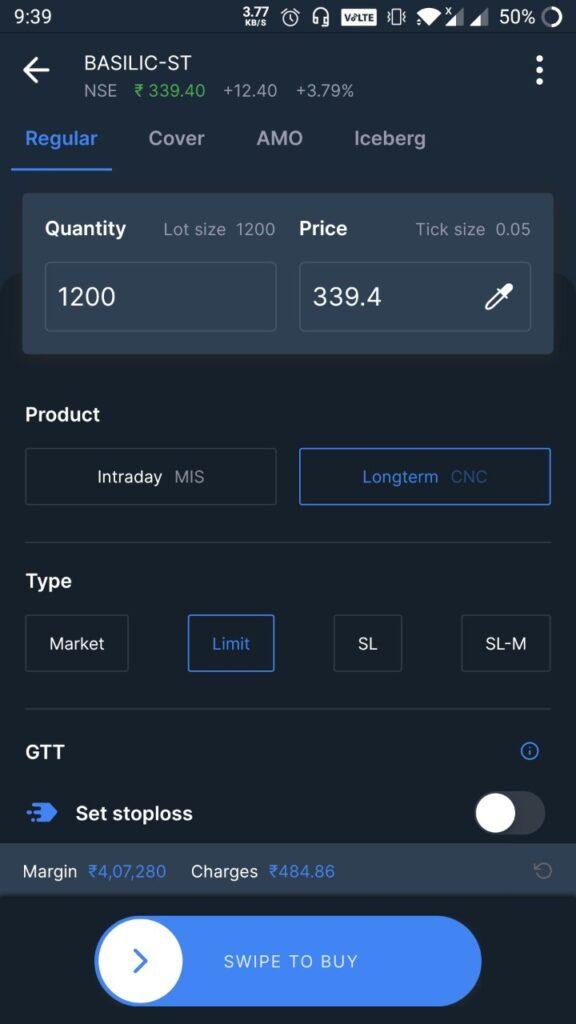

- For example: In Basilic Fly Studio SME, IPO has Lot Size:1200 shares and only multiples of this can be traded.

So if you want to buy or sell Basilic Fly shares, you would have to buy/sell 1200 shares atleast or it’s multiples like 2400, 3600 and so on.

It had IPO offer price of ₹97.

Can Retail or HNI apply for SME IPO?

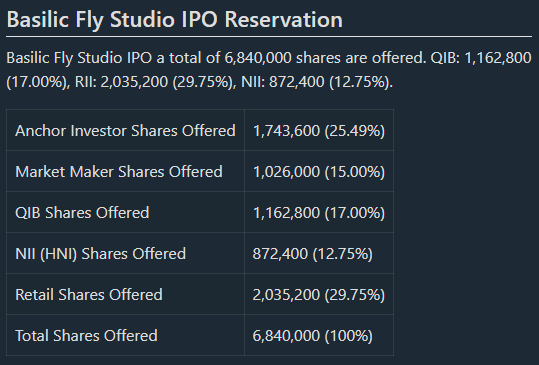

Yes, both Retail and HNI quota is reserved in SME IPO some even have QIB/institutions quota.

1. Although Retailers have to bid for one lot size that is always more than 1 Lakh.

2. HNI/NII always have minimum 2 Lots that is always above 2 Lakhs.

Refer Example of Basilic Fly IPO Reservation below-

Risks Associated with SME IPOs

While the advantages of SME IPOs are compelling, it’s crucial to recognize that they come with their own set of risks. Here’s a detailed look at these risks:

1. Market Volatility:

SME IPOs are susceptible to market volatility. Fluctuations in stock prices can impact the performance of these IPOs, potentially resulting in losses for investors. Sometimes the stock can get into lower or upper circuits in no time, make sure to hold a stock or make positions after due research only.

2. Lack of Liquidity:

Stocks from SME IPOs may not be as liquid as those from larger companies. Finding buyers and sellers can be challenging, making it difficult to enter or exit positions. This being one of the main risks of SME IPO, make sure to research beforehand.

3. Regulatory Compliance:

SMEs must adhere to stringent SEBI regulatory requirements. Non-compliance can lead to legal issues and loss of investor confidence.

There have been issues of poor corporate governance in SME IPO more often than Mainboard.

4. Limited Track Record:

Many SMEs lack an extensive financial track record, making it challenging for investors to assess their long-term viability. Another aspect also includes high possibility of window dressing of company financials.

Best SME IPO Lisitng Strategy

Given the above risks in SME IPOs there has to be a general defined strategy on lisitng, this should be your general go-to strategy and not for the ones you have extensively researched and know inside out of the company and thought of not selling it for listing gains.

1. If you have received allotment always give high consideration on using the PRE-OPEN Window of IPO Listing Day, which is always between 9:15 to 9:45 AM strictly.

2. In the PRE-OPEN time period you have to place only LIMIT SELL order (other than LIMIT will get rejected) , in this period all such BUY and SELL Limit orders are calculated by exchange based on Supply and Demand to reach at a listing price.

3. Now in this time frame you have to place LIMIT SELL above let’s say 75% of the Offer Price of IPO, here any new user might also think why would you sell for anything at loss. So LIMIT Order works like your order will only get triggered on price above 75% of offer price and will be sold.

Example: BASILIC FLY SME IPO Offer Price was 97 —- then 75% of 97 = around 73, Now place Limit Sell Order @ 73. The Listing Price was 271 according to supply and demand of orders in PRE-OPEN your shares will get sold at 271, being higher than 73.

4. The order gets triggered and sold at 9:45 AM , then real secondary market/trading will start at 10:00 AM and money will be in your account at rate of 271/share. 😀

NOTE: Very few DP like Zerodha and Upstox provide Pre-open IPO sale orders.

Case Studies: SM5E IPO Success and Failures

To illustrate the potential outcomes of SME IPO investments, let’s examine two contrasting case studies examples of SME IPO:

Success Story:

Example of amazing SME IPO Knowledge Marine & Engineering Works Limited , the shares got listed on BSE SME on March 22, 2021 was listed at 3-4% premium but stands at 4136.08% massive gains as of September 2023. Over the years, the company executed its growth plans effectively, and its stock price soared. Investors who held onto their shares realized huge gains.

Cautionary Tale:

We can see example of poor performance of SME IPO Rangoli Tradecomm Limited, listed on March 22, 2021 at 6-7% premium but as of September 2023 it stands at 96% loss, faced challenges post-IPO. Poor management decisions and sectoral headwinds led to a declining stock price, resulting in losses for investors.

Mitigating Risks in SME IPO Investments

While SME IPOs come with risks, investors can take steps to mitigate these challenges:

1. Thorough Due Diligence:

Conduct extensive research into the company’s financials, business model, and market potential.

2. Consult Experts:

Seek advice from financial experts who specialize in IPOs and SME investments.

3. Diversification:

Don’t put all your eggs in one basket. Diversify your investment portfolio to spread risk.

4. Long-Term Perspective:

Approach SME IPOs with a long-term perspective. Stock prices may fluctuate in the short term, but a well-run SME can deliver value over time.

5. Stay Informed:

Keep notice of market developments, regulatory changes, and the company’s performance.

Conclusion

In conclusion, SME IPOs present exciting opportunities for both companies and investors. However, it’s essential to be aware of the risks and conduct thorough research before committing capital. The SME IPO landscape is dynamic, and informed decision-making is key to navigating it successfully.

As you explore the world of SME IPOs, remember that while the potential rewards are significant, the risks are equally substantial. Approach SME IPOs with caution, diversify your investments, and stay informed. With the right strategy, SME IPOs can be a valuable addition to your investment portfolio.

Latest 2023 SEBI Mainboard IPO ALLOTMENT RULES for better chances of allotment, Click here.