In the fast-paced world of investment, opportunities often come in the form of Initial Public Offerings (IPOs). SME IPOs, in particular, have gained significant attention due to their potential for substantial returns. However, understanding SME IPO allotment process, especially for Non-Institutional Investors (NII) and Retail Investors, is crucial to avoid risks. In this comprehensive guide, we will delve into the SEBI SME IPO allotment rules for NII and Retail Investors and explore strategies on how to secure SME IPO allotment successfully.

Introduction to SME IPOs

SME IPOs, also known as Small and Medium Enterprises IPOs, are initial public offerings specifically designed for small and medium-sized companies. These companies use the IPO route to raise capital from the public for various purposes, including expansion, debt repayment, and working capital.

Investors are drawn to SME IPOs because of the potential for significant capital appreciation. However, the allotment process for SME IPO shares is subject to regulations set by the Securities and Exchange Board of India (SEBI). These regulations are designed to ensure fairness and transparency in the allocation of shares.

Everything about SME IPO [Explained] | Risks | Best Examples 4000% Returns [September 2025]

SEBI Regulations for SME IPO Allotment

– Eligibility Criteria for Retail Investors

Retail Investors play a vital role in SME IPOs. To be eligible as a Retail Investor, an individual must adhere to the following criteria:

- The investor should apply for shares worth at least 2,00,000 in the SME IPO from April 2025.

– Eligibility Criteria for High Net worth Investors

Non-Institutional Investors (NIIs) are high-net-worth individuals. To be eligible as an NII in SME IPOs, an investor must meet the following criteria:

- Revised Allocation Methodology for HNI:

- The allocation to HNIs will now follow a draw of lots method, similar to main board IPOs i.e lottery, instead of proportionate allotment.

- The NII portion will be split: one-third reserved for applications between two lots and ₹10 lakh, and two-thirds reserved for applications exceeding ₹10 lakh.

- Why it matters: This is intended to ensure a fairer distribution of shares among NIIs and mitigate risks associated with over-leveraging.

Understanding the SME IPO Allotment Process

The SME IPO allotment process by SEBI has mandated that SME IPOs follow:

1. Retailers: Lottery Draw System

2. HNI/NII: Lottery Draw system from 2025 April. Under this system, the allotment is made in such a way that all eligible investors receive shares in proportion to their application size.

Few other specific rules for HNI/NII application:

1. What sets this category apart from others is that investors here cannot bid at the cut-off price, nor can they withdraw or modify their bids.

2. Furthermore, there is no lock-in period for both HNIs, can sell their shares on the listing day to realize profits just like retail category.

Best process to Apply for SME IPO

To be considered appropriately in basis of allotment under SME IPO Allotment Process, one must apply without errors in application, here’s the process to apply in SME.

– Demat Account and UPI

Ensure you have a Demat account and a UPI (Unified Payments Interface) ID linked to your bank account.

1. Go to IPO section and click apply of that particular IPO.

2. Fill in the Shares in multiple of lot size, 2 lot for retail and more than 2 for NII/HNI Category.

3. Select the Cut off price, if oversubscribed.

4. Accept the Terms and Conditions and click Submit.

Note: Although UPI daily transaction Limit is 1 Lakh but few demat allows UPI mandate for SME IPO till 5 lakhs, check yours beforehand.

– ASBA Facility

Use of ASBA (Application Supported by Blocked Amount) facility provided by your bank is always better option. This facility ensures that the application amount remains blocked in your bank account until the allotment process is completed.

1. Find ASBA/IPO option in your bank’s Netbanking website or mobile app.

2. Add Beneficiary Details if you have Demat account with any other DP (instead of your ASBA bank) such as Zerodha, Upstox etc.

3. It would ask for CDSL/NSDL and DP ID/BO number that is usually 16 or 8 digit number that you can find in Profile/Settings>>Demat of Zerodha, Upstox etc.

4. Then fill in your Bid details of shares and Price, system will automatically put you in respective Retail, NII/HNI categories.

5. Make sure the details are correct and then Submit.

6. The cutoff time for ASBA IPO application submission is usually 3:00 PM on closing day of IPO, please find your bank’s timings to be on safe side.

7. Don’t apply 3rd Party ASBA IPO application, it has been stopped by almost all banks, check with yours first.

WHAT NOT TO DO?

1. Don’t place bid lower than cutoff if oversubscribed, your application will get rejected first (every IPO almost 2% get rejected like this).

2. Don’t apply 3rd Party ASBA IPO application, it has been stopped by almost all banks, check with yours first.

Strategies to Increase Chances of SME IPO Allotment

Investors can adopt several strategies to enhance their chances of securing SME IPO allotment:

– Applying with Multiple Demat Accounts

Investors can apply for SME IPOs using multiple Demat accounts in the family’s name, as in other words different PAN card. This increases the chances of receiving more allotments.

– Leveraging the Cut-off Price Option

Choosing the “cut-off price” option can enhance your chances of allotment. This option allows investors to bid without specifying a price, and shares are allotted at the final issue price.

– Participating in the Retail Category

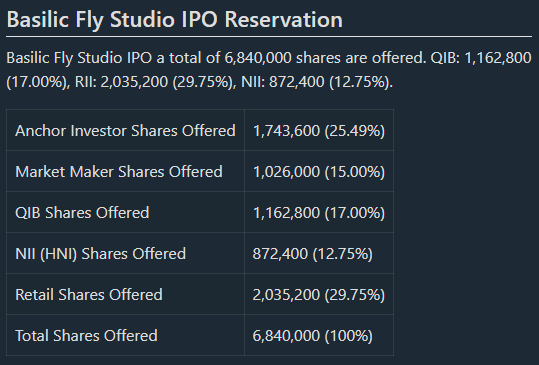

Retail investors can benefit from the Retail category, which often receives generally more than double allocation percentage compared to NIIs. Applying in the Retail category can improve your chances of allotment.

Refer the SME IPO as an example below.

What is Basis of Allotment in SME IPO?

Follows same as of Mainboard IPO.

Refer: Latest SEBI IPO Allotment Rules for HNI – Mainboard [2025] | Basis of Allotment (BoA) Tricks | Best Process to apply IPO in HNI from Zerodha, Upstox etc.

Conclusion

SME IPOs offer exciting investment opportunities, but securing allotment requires a clear understanding of SEBI regulations and strategic planning. By following the rules and implementing effective strategies, investors can maximize their chances of successful SME IPO allotment.

Frequently Asked Questions (FAQs)

Q1: Can an I apply for an SME IPO with family member’s multiple PAN cards?

A1: Yes an individual can apply for an SME IPO with family’s multiple PAN cards. SEBI has strict regulations against using single PAN and multiple applications and applications are also thoroughly scrutinized for duplicate PANs.

Q2: Are SME IPOs risk-free investments?

A2: No investment is entirely risk-free. SME IPOs, like all investments, carry inherent risks. It’s essential to conduct thorough research and due diligence before investing in any IPO.

Q3: What happens if I don’t receive an allotment in an SME IPO?

A3: If you do not receive an allotment in an SME IPO, the blocked funds in your bank account will be unblocked, and you can use them for other investments.

Q4: Can I sell my allotted SME IPO shares immediately after listing?

A4: Yes, you can sell your allotted SME IPO shares in the secondary market immediately after listing, subject to market conditions and trading rules but better to sell in pre open market to avoid risks later.

Q5: How can I check my SME IPO allotment status?

A5: You can check your SME IPO allotment status on the SME IPO registrar’s website or through mail from Demat account provider.

In conclusion, investing in SME IPOs can be rewarding, but it requires adherence to SEBI regulations and the implementation of effective strategies. By following the outlined guidelines, investors can navigate the SME IPO allotment process with confidence and potentially capitalize on exciting investment opportunities.